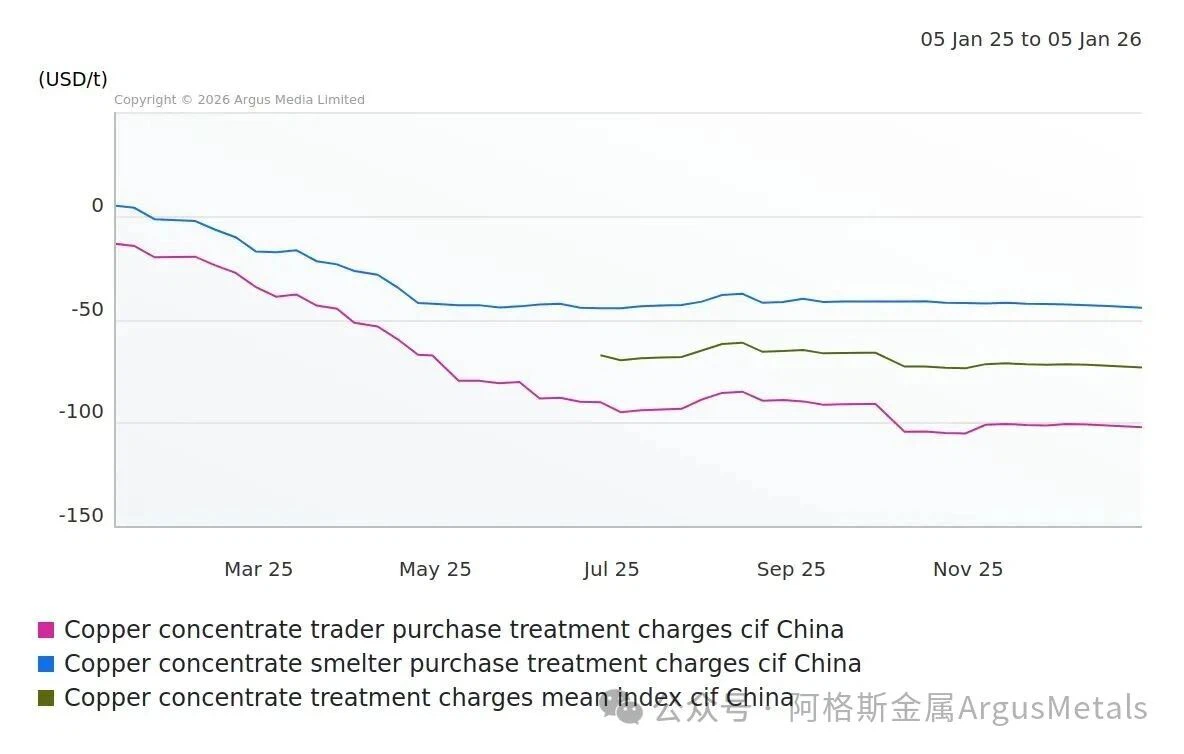

The copper concentrate processing and refining fees (TC/RCs) of Chinese smelters continued to decline last week. The market expects that the supply of copper concentrate will remain tight next year. The Agence France-Presse (Agence) weekly purchase index for smelters dropped from -44.20 US dollars/ton and -4.42 cents/pound on December 26 to -44.60 US dollars/ton and -4.46 cents/pound on December 31. The trading index for buyers dropped from -101.90 US dollars/ton and -10.19 cents/pound to -102.3 US dollars/ton and -10.23 cents/pound. The average weekly copper concentrate TC/RC index of Agence dropped from -73.05 US dollars/ton and -7.305 cents/pound on December 26 to -73.45 US dollars/ton and -7.345 cents/pound on December 31. A batch of 10,000 tons of clean ore was purchased by the smelter at a processing fee of -40 US dollars at the lowest level, with the quotation period being M+1/5 and delivery in January.

The market activity was limited in the days before the New Year holiday. Despite the slowdown in new smelting capacity, the demand for copper concentrate from smelters is expected to still exceed the supply from mines in 2026. Market participants expect a shortage of 650,000 to 850,000 tons of copper concentrate in 2026. Mining News China's mining company, Minmetals, will expand its production capacity at the Komak copper mine in Botswana. It is expected that the copper output of the mine will increase from 4.3-5.3万吨 this year to 130,000 tons. Chinese diversified mining company Zijin Mining announced that its copper production in 2025 will increase compared to last year. Zijin produced 1.09 million tons of copper concentrate in 2025, with a year-on-year growth of 2%.